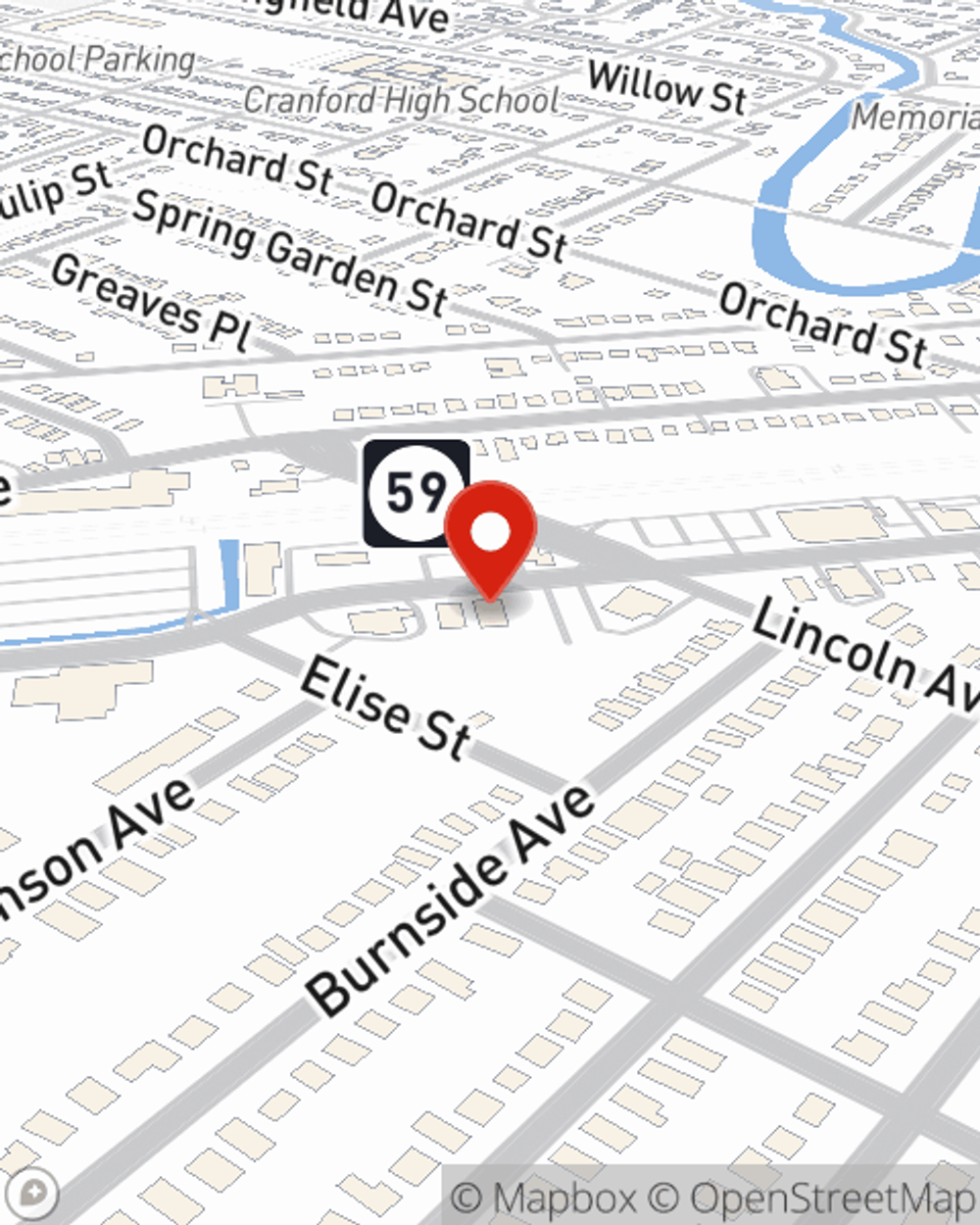

Condo Insurance in and around Cranford

Here's why you need condo unitowners insurance

Quality coverage for your condo and belongings inside

Welcome Home, Condo Owners

When it's time to wind down, the home base that comes to mind for you and your favorite peopleis your condo.

Here's why you need condo unitowners insurance

Quality coverage for your condo and belongings inside

Put Those Worries To Rest

Your condo is a special place. You need condo unitowners coverage to keep it safe! You’ll get that with Condominium Unitowners Insurance from State Farm, a trusted name for condo unitowners insurance. Gary Wilks is your dependable State Farm Agent who can present coverage options to see which one fits your individual needs. Gary Wilks can walk you through the whole coverage process, step by step. You can have a hassle-free experience to get coverage options for everything that's meaningful to you. We’re talking about more than just protection for your linens, home gadgets and furnishings. You'll want to protect your family keepsakes—like souvenirs and collectibles. And don't forget about all you've collected for your hobbies and interests—like sports equipment and videogame systems. Agent Gary Wilks can also let you know about State Farm’s great savings and coverage options. There are savings if you carry multiple lines of State Farm insurance or have an automatic sprinkler system, and there are plenty of different coverage options, such as personal articles policy and even additional business property.

Ready to learn more? Agent Gary Wilks is also ready to help you see what customizable condo insurance options work well for you. Get in touch today!

Have More Questions About Condo Unitowners Insurance?

Call Gary at (908) 800-0030 or visit our FAQ page.

Simple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.

Simple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.